TOPICS:

Chatbot for Finance Building a chatbot

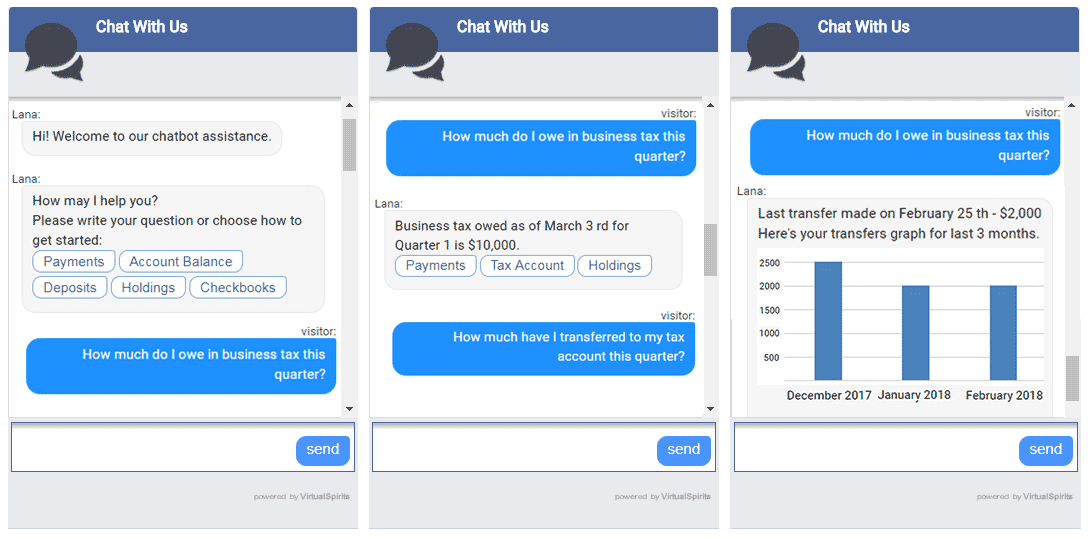

Banking chatbot: Chatbots can replace your banking apps

Banking chatbots have already started to replace apps at websites, simply because they allow customers instant service and answers.

The quality and responsiveness of a bank’s customer service often becomes the differentiating factor separating it from the competition. This is partly why prominent banking institutions have turned towards online chatbots as a possible replacement for some elements of their customer support.

Let’s look at how they manage to do that.

On-demand banking with a personal touch of chatbot

Users may appreciate the ready availability of a banking app, but the fact remains that these apps lack a personal touch. At the same time, offering day-to-day banking services in person or over the phone is hardly realistic for a bank in this day and age. Banking website chatbots offer the perfect middle ground. They combine the immediacy of instant chats with the experience of talking to a ‘person’ at the other end of the chat window. Even when customers are aware that they are in fact interacting with a bot, the fact that they’re getting their information over the course of a one-on-one conversation, makes it a better experience.

Banks often put a great deal of effort into chatbot development, which leads to chat scripts that are designed with a high level of detail. Through them, banking chatbots put customers at ease about the safety and availability of their funds, thus strengthening their trust in the bank.

Instant access to information and assistance with chatbot.

Banking apps may have all the functionalities that a user might need, but locating a particular function or piece of information can often be an uphill task. For example, the option to liquidate a fixed deposit could be tucked under layers of more obvious features like money transfers or bill payments. This makes banking apps frustrating to use at times, and is precisely why banking website chatbots are so helpful. In order to find out about a product or holding, or perform basic banking tasks, all that a user needs to do is ask the chatbot.

So in the example we just took up, the user needn’t spend time looking for a way to liquidate their deposit. They can just go to the chat window where their bank’s chatbot is waiting for instructions, and type,

“I want to liquidate my fixed deposit.”The chatbot will respond,

“Sure. Let me check on that for you…Is this [Deposit ID], for [dollar amount], maturing on [date]?”User:

“Yes.”Chatbot:

“Would you like to liquidate it in full?”User:

“Yes.”Chatbot:

“Sure. The standing instruction on the deposit says that the funds should be sent to your savings account. Is that what you would like to do?”User:

“Yes.”Chatbot:

“Got it. I have initiated a request, and you should see the funds in your account by the end of the business day. Here is your service request ID.”Readily available financial advice through chatbot:

Banks don’t just create a chatbot to answer customer’s questions and perform banking transactions at their request. While building chatbots, banks and other financial institutions can program them to be able to offer investment and money management advice as well. This can cover a wide range of financial arenas, ranging from personalized advice on a customer’s current and projected financial position, to real-time information on the stock market. The following are some examples of questions that the best chatbots for banking and financial services can successfully answer.

“Which of your investment options has the best interest rate?”“Which stocks are hot right now?”“Is this a good time to invest in [stock name]?”“I’m expecting to receive a $5000 bonus. What do you recommend I do with it?”In addition to this, customers can also opt to receive daily updates on stocks they’re interested in, or notifications about promotional offers on financial products they can potentially invest in. Given these functionalities, it is only a matter of time before online chatbots completely replace banking apps.

How else will online chatbots transform financial services? Read our other blog posts, or get in touch with us for specific queries on chatbot development.