TOPICS:

Chatbot for Finance Building a chatbot

Chatbot for insurance - 5 reasons why chatbots are taking over the insurance industry

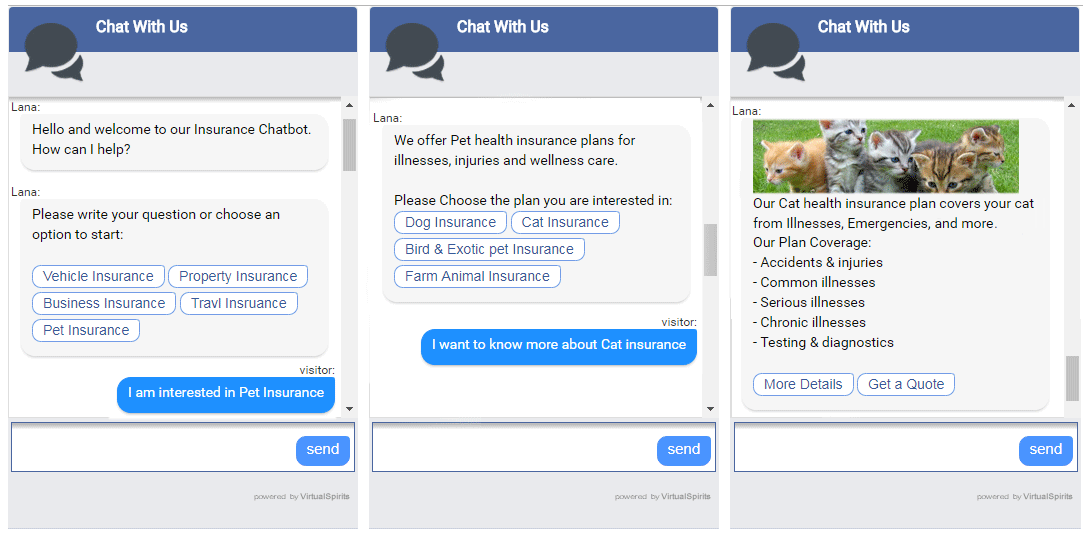

The new-found success of chatbot development has impacted numerous industries. The results are particularly noteworthy for insurance companies, who are rapidly deploying chatbots on their websites and through messenger platforms. This article outlines 5 important reasons why insurance chatbots are becoming irreplaceable for insurance companies and brokers.

1. Insurance Chatbots can effectively educate potential insurance buyers.

Insurance doesn’t usually feature on the list of things that people buy willingly. This is primarily due to the fact that the process of buying insurance entails cumbersome paperwork, pages upon pages of fine print, and a lengthy sequence of steps that include background checks, approvals, and more. Perusing insurance policy documents is in itself a challenge, especially for first-time buyers who are unfamiliar with the industry’s vocabulary and practices. This is where insurance chatbots have their first important role to play.

Online chatbots on insurance websites act like interpreters for potential buyers. Their interaction starts with the chatbot asking the user for basic details such as their age, profession, type of insurance needed, annual income, and so on. They are then able to process these details quickly, and shortlist insurance policies that are tailored to the person’s requirements and preferences. As such, the potential buyer has a smaller list of options to consider, and will need less time to review and understand them. Of course, the insurance chatbot remains available to answer questions about the policy documents and put the potential buyer’s doubts to rest.

2. Chatbots simplify the insurance buying process.

One of the key factors that insurance companies consider while building chatbots for their websites, is the general public’s aversion to insurance-related paperwork. In order to purchase insurance, a person has to fill out lengthy forms, which are typically full of confusing fields and vocabulary that is difficult to understand. Once again, chatbots can wear the personal assistant’s hat, asking the buyer simple questions in a conversational language, and using them to auto-populate some of the fields on the online form. This makes life much easier for the buyer, and significantly speeds up the application process.

3. Insurance chatbots allow 24/7 filing of claims.

One of the main reasons why chatbots have become so popular for online businesses, is the fact that they remain functional round the clock, irrespective of time zones, business hours, or public holidays. As such, insurance companies that create a chatbot for their websites, are able to add ‘24/7 claim filing’ to their list of USPs.

Accidents, thefts, medical emergencies, and other situations that entail the need for filing an insurance claim, may or may not occur during business hours. If an insurance company has online chatbots on its website, its clients can file their insurance claims at any hour of the day or night, right through the chat window. This assurance of on-demand assistance encourages potential buyers to choose these companies over their competitors.

4. Chatbots are great at customer support.

Insurance companies aren’t usually associated with great customer service. But by building chatbots for their websites, they can change that impression. As mentioned in the previous section, chatbots stay active round the clock. This makes it possible for insurance buyers to get support as and when they need it.

For instance, a buyer can converse with the insurance chatbot at 10 in the night to check when their next premium is due, or whether a certain medical procedure is covered by their health insurance policy. Not only can the chatbot answer these simple questions, it can also file a ticket on the buyer’s behalf if they have a more complex question that the chatbot cannot answer. The buyer can then receive a call from their insurance agent on the next business day and get their query resolved.

5. Insurance chatbots can offer new policy suggestions.

Insurance chatbots are powerful lead generators, mainly because they are able to understand the needs of their customers and suggest policies that will suit them best. After interacting with insurance buyers over a reasonable length of time, the best chatbots for insurance companies can recommend new policies that will suit them better than their existing ones. They can also pitch limited period offers and discounts on premiums as and when the company comes up with them. Experience shows that these prompts sent via instant chat have a greater likelihood of getting a positive response from the user, as compared to traditional methods of promotion such as ads, emails or phone calls.

To understand the role of insurance chatbots in more detail, or for tailored advice on chatbot development for your business, get in touch with our team right here.