TOPICS:

Chatbot for Finance Building a chatbot

Chatbot for insurance: How can chat bots enhance the insurance experience?

In an industry that is inseparable from tedious paperwork, long waiting times, and inexplicable terminology, chatbots for insurance have a mountain to climb. Their job is to bust these stereotypes that buying insurance and filing claims have come to be associated with. But going by their performance over the past couple of years, online chatbots for insurance have already improved the insurance experience by leaps and bounds. Let’s look at some of the ways in which they do that.

Chatbot for Insurance provides round-the-clock availability:

Chatbots remain operational on insurance websites at all hours, allowing insurance companies to attend to potential buyers even on weekends, holidays, or outside of business hours. Not only that, online chatbots are also immune to fluctuations in website visitor traffic, and are able to offer the same response rates at peak and off-peak hours. Together, these factors help insurance websites offer great user experiences, which contribute towards more leads and policy purchases in the long run.

Educational support with chatbot for insurance:

A person visiting an insurance company’s website may be interested in buying insurance, but that does not guarantee that they’ll actually go ahead and make a purchase. This is because potential insurance buyers, especially those doing it for the first time, don’t know how to interpret all the specifics and benefits of the various insurance policies listed on the site. Online chatbots for insurance help by shortlisting policies on their behalf.

Let’s imagine that 30-year-old Ned is mulling over the idea of buying health insurance for himself and his family. He arrives at the website of an insurance company he’s been recommended and sees that they offer multiple health coverage policies. He could go through them in detail on his own, which would likely take hours. Or he could respond to the online chatbot’s message on a corner of his screen.

Chatbot:

“Hello, and welcome! Would you like some help choosing one of our policies?”Ned:

“Yes.”Chatbot:

“I’ll be happy to help you. What kind of insurance are you looking for today? [Life/health/car/travel]”Ned:

“Health.”Chatbot:

“All right. Could you help me narrow down some options for you by giving me a few details? Please answer the next few questions by selecting the options that apply to you.”Over the next couple of minutes, the chatbot for insurance collects details including Ned’s age, annual income, budget range, health conditions, as well as basic information about his dependents. It then recommends the health insurance policies that are best suited to Ned’s requirements and preferences. Ned now has fewer options to compare and analyze, and his task is significantly easier.

Simplifying insurance terminology:

Let’s continue with Ned’s example. The insurance chatbot has already shortlisted potential insurance policies for him. He now needs to read them in detail and make his final decision. This is where he’ll need some help as a first-time insurance buyer. Insurance policies are ridden with complex terms and phraseology, which laypersons can find hard to understand. Luckily, insurance agencies are now building chatbots to simplify this terminology for potential buyers.

While Ned goes through the policy documents, the insurance chatbot will wait patiently on the side. As and when he comes across a term or a clause that he doesn’t quite understand, he can ask the chatbot to explain it to him in simple words. The best chatbots for insurance companies are loaded with chat scripts that include FAQs about policies and claim filing. This way, they are able to answer most of the common questions that people like Ned are likely to ask them.

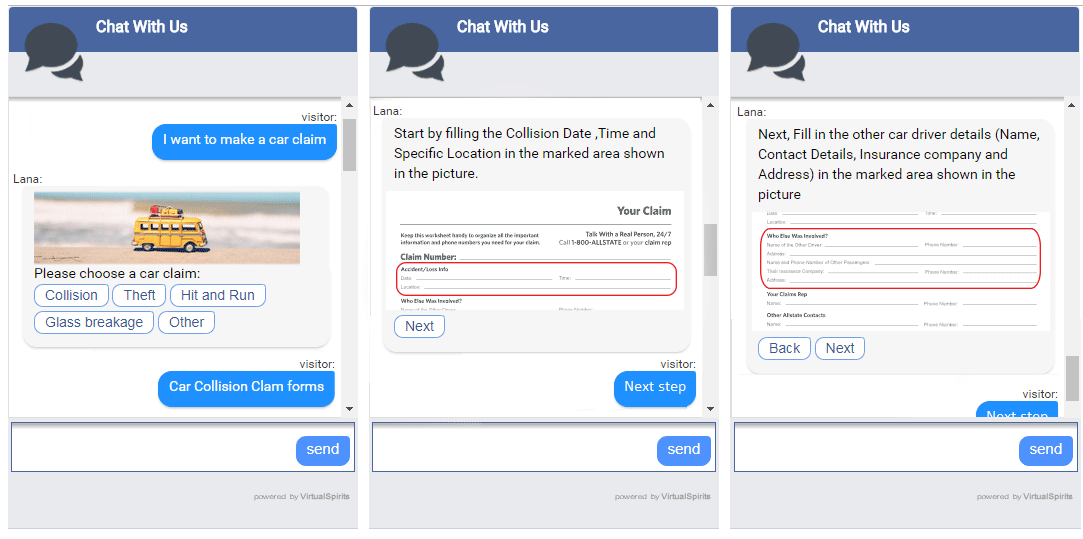

Instant claim filing using chatbot for insurance:

The trouble for most insurance policy buyers starts when they actually need to file a claim. They have to fill out forms, furnish documents and receipts, and wait for approval – all while they’re short on funds. Insurance chatbots can make the process less tiresome. First up, they’re online round the clock, which means that someone whose loved one has been in an accident on Saturday doesn’t need to wait until Monday to call the insurance company and file a claim. They can start the process online, by just telling the chatbot,

“I need to file a claim.”The chatbot can pull out all the relevant forms, auto-populate them with the claimant’s basic details, and help them with any questions they have while filling out the rest of the fields. The claimant will get an acknowledgment number at the end of the process, which they can use to check the status of the claim. If they don’t hear back from an agent in a few days, they can just ask the chatbot a question like,

“What’s the status of my claim?”And the chatbot will instantly respond with a friendly

“Let me check on that and get back to you.”In difficult times, the last thing an insurance buyer wants is a hold-up at the insurance company’s end. Knowing that they always have a way to connect with the company and ask for an instant update, goes a long way in reassuring them.

Find out more about insurance chatbot development in our blog, or get in touch with us for specific information on how to create a chatbot for your agency’s website.