TOPICS:

Chatbot for Finance Chatbot for Service Chatbot Trends

Chatbots in Banking - Conversational Banking With Bots

Let's take a closer a look at chatbots in banking. The way chatbots have been designed, they are quite proficient in assisting humans with their various tasks. While some of them are easier in their design, few are intricate enough to astonish individuals with their tech-savvy capabilities. This technology has a great amount of potential in almost every industry, especially for banking. AI bots can be very beneficial for banking consumers who wish to have customer experiences and complete their transactions without facing any time-consuming obstacles.

Given below are the benefits of chatbot for banking industry:

1. Never-ending customer support service using bots

In today’s competitive world, serving the customer right way and in the most personalized way is the key factor for a business to grow. Providing 24/7 customer service and ensuring complete customer satisfaction can help a banking institution sustain itself in the competitive market for a very long time. They can help the banks with their everyday jobs like customer queries, and informing them about bank’s new products and services.

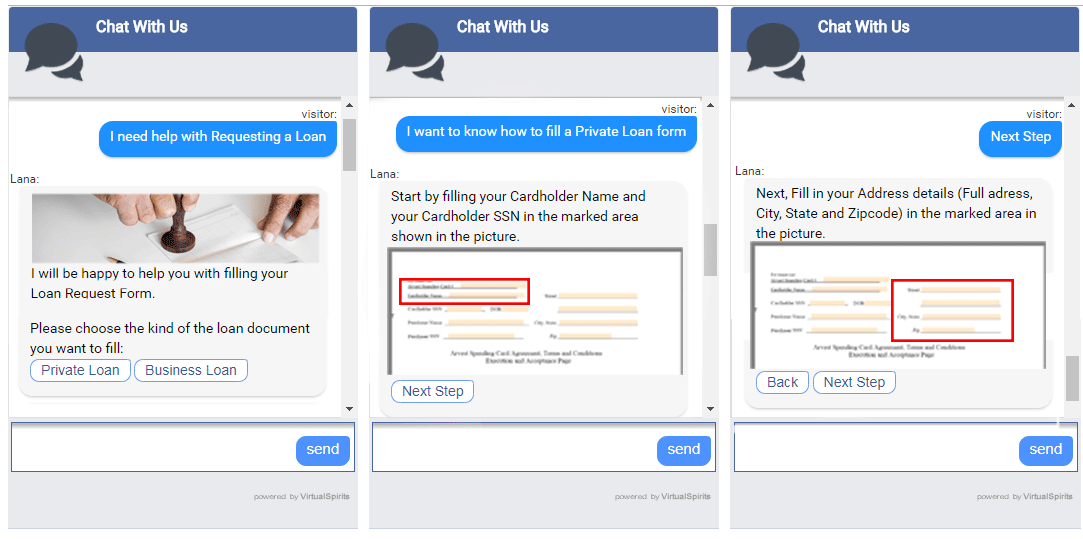

2. Chatbots help customers with complicated procedures

It has often been noticed that banking customers find it very irritating when it comes to going through the lengthy online authorization procedure. All through the procedure, they have to fill up their details repeatedly to ensure their authenticity. The chatbots are capable enough to help the customers with that. They can make things very convenient for the customers and help them understand the intricacy of the banking procedures.

3. Automated banking chatbots

While Chatbots are an exceptional tool for interacting with clients and helping them, they have also proved their specialization in detection of fraudulent practices, getting analytics, and apprehending data. They also help in generating automatic notifications about the transactions to keep the customers updated with their account events in real-time.

4. Testing customers’ engagement towards new products and services

Banking industry offers various types of products and services for its clients. However, not every customer knows about these products and services. There chatbots can be very useful in distributing the knowledge about different products and services to the end users. They send not only the details, but also analyze the users’ interest and engagement on them.

5. Chatbots bring a human touch to the automated services

The chatbots are also very capable of bringing a human touch in their automated services, which ultimately can strengthen the bond between technology, customers, and bank staff. Customers won’t feel like they are talking with a machine, instead of a human being...

Chatbots play a very vital role in resolving the problems that are very basic or time-consuming for the humans. They not only save time, but also complete every procedure flawlessly. And the most interesting thing is that chatbots and humans can work together in the industry to provide best services for the customers and provide more than 100% satisfaction for them.