TOPICS:

Chatbot for Finance Building a chatbot

Financial services chatbots: Chatbots are the future of financial services

When they say that by 2020, AI bots will be handling 85% of the world’s customer service interactions, they’re definitely not exaggerating. We already interact with chatbots on a regular basis, asking them to dim the lights, responding to their messages about promotional offers, and even letting them drive our cars. That they can also help us manage our funds better, isn’t such a far-fetched idea, is it?

When it comes to managing and monitoring our finances, most of us would appreciate a little help. Which is what financial services chatbots are built to do. Leading global banks already use them, plugging them into their existing online customer support system. Here are some of the things these bots do to make money management simpler.

1. Chatbots Organizing personal finances:

We’d all like to make better financial decisions. But most of us would agree that we’d like to spend as little time as possible pondering over our finances. Well, with chatbot development making inroads into the financial services industry, achieving both these ends at once will soon be possible.

A lot of people use money management tools and apps to organize their funds better. Even banks have started offering these services to their customers, enabling them to keep an eye on all their assets in real time. The best chatbots in the financial services industry even go so far as to offer investment advice. For instance, they can analyze your current financial position to estimate how long it would take you to pay off your home loan, or whether it would make sense to buy a car in this quarter.

When developed to offer credible advice and make accurate projections, a financial services chatbot that you can interact with 24/7, can be a life-saver.

2. Chatbots helping with expense tracking and alerts:

A big part of keeping your finances organized involves staying abreast of your spending trends over time. This is one of the key benefits of having access to a financial services chatbot. Online chatbots that banks offer on their websites and mobile apps are often programmed to be able to track your expenses, sorting them into different categories. A user can access this information by just chatting with the bot.

Chatbot:

“Good morning! How can I help you?”User:

“I need my expenditure data for last month.”Chatbot:

“Sure. Here’s a link to download a spreadsheet of last month’s expense data.”User:

“How much did I spend on take-out last month?”Chatbot:

“[Dollar amount] spent under sub-category ‘Take-Out’, category ‘Miscellaneous’.”Through interactions like the one illustrated above, the user can always know which expenses they need to cut down on. They can stop a subscription that they’ve been paying for but not using, or ask the chatbot to set up alerts for whenever a particular expense exceeds a pre-set amount. Like in the above example, the user can add,

“Set up a monthly spending alert when take-out crosses $200.”3. Managing business expenses for tax deductions:

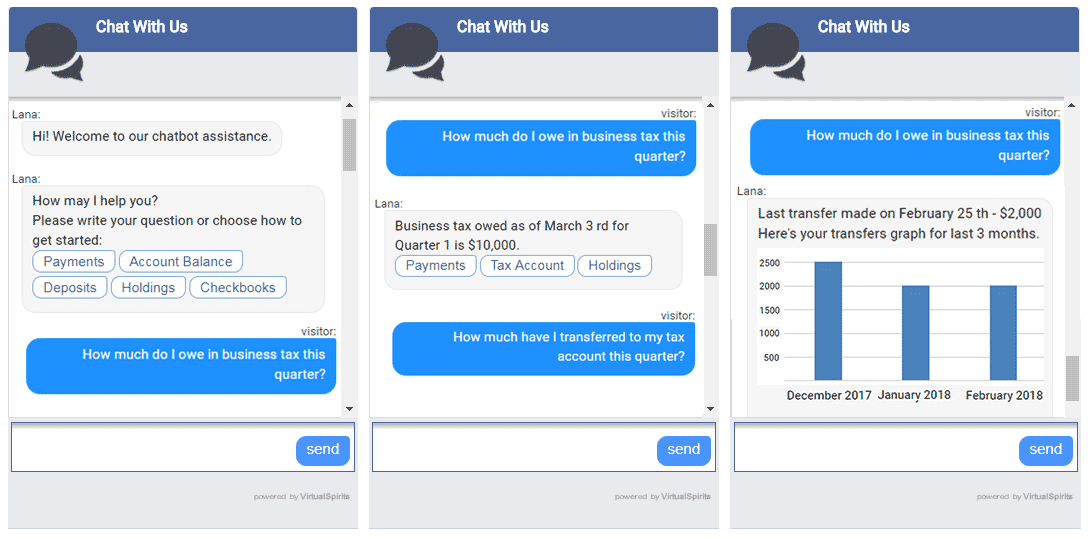

Chatbots don’t just act as your personal finance assistants. As a business owner, you can use bots to manage your business expenses as well. Just like with your personal expenses, you can allocate a portion of your funds towards business expenses, making it easier for you to make deductions for taxes at the end of the year. And you can ask your chatbot to bring you up to speed from time to time. Like for example:

User:

“How much do I owe in business tax this quarter?”Chatbot:

“Business tax owed as of [date] for [Quarter X] is [dollar amount 1].”User:

“How much have I transferred to my tax account this quarter?”Chatbot:

“[dollar amount 2], last transfer made on [date].”User:

“Transfer $1500 to tax account.”4. Performing simple online transactions with Chatbots:

This brings us to the last aspect of using online chatbots for financial services. In the example that we just looked at, the user was able to find out how much he/she owed as business tax in a quarter, and transfer the balance amount to an account maintained just for taxes. Both the tasks were performed by the banking chatbot at the user’s request. The best chatbots for financial services are equipped to be able to handle a variety of simple requests like these. Users can just give the bot simple, one-line instructions like:

“Transfer $500 from [Account 1] to [Account 2].”“Pay credit card bill.”“Give me the details of my last 5 transactions.”The user can also ask questions like:“What is my recurring deposit balance?”“What are my top holdings?”“How long will it take to get a new checkbook?”And so on. Banking chatbot development takes these commonly placed requests and frequently asked questions into account, so as to give users a smooth and hassle-free money management experience.

Want more information on banking and financial services chatbots? We’ll be happy to answer your questions, or guide you on how to create a chatbot for your finance-related service. Just leave us a message.