TOPICS:

Chatbot for Finance Chatbot for Service Chatbot Trends

Insurance Chatbot - Benefits of using chatbots for the industry

The insurance chatbot is a killer app waiting to be unleashed. When talking about insurance industry, first thing that comes to people’s mind is lengthy forms, questionnaires, onerous background checks, staff scarcity, and an unwieldy customer support service. Studies show that most of the customers around the world are not big on trusting insurance industry as compared to supermarkets, banks, and car builders. The inexhaustible potentials of improvement that comes with Artificial Intelligence now has to offer, insurance companies would have to work harder to win new customers and retain older ones. Taking a significant step towards it, the insurance industry is moving towards building chatbots to stay at the top of their game.

Chatbots for Insurance Industry

Insurance companies encompass monotonous, inefficient, and drawn-out questionnaires. However, Chatbots can easily engage customers by sending them text with little snippets replying to their questions looking for straight answers. They help in evading idleness as they can swiftly analyze the data they gather from the customer so as to work out the risk involved with their profile. Chatbot can easily modify the conversation to make it more personal and welcoming for the customer. Given below are the benefits of chatbot for insurance industry:

Chatbots help finding new customers

According to a study conducted by

Forbes, around 70% of people now prefer to buy the insurance policy through their mobile phone. When customers go to an insurance company website, the chatbot can converse with them about what they are looking for and make it easy for them to find that. It can get for whatever product customer is interested in within shortest amount possible.

Chatbots for better marketing results

Chatbots are very effective when it comes to engaging the customers in a welcoming manner and help them find their desired products. As, chatbots can possibly connect with indefinite number of customers at once, it means that insurance company can easily bring down the marketing costs and get more effective results.

Chatbot for enhanced customer support service

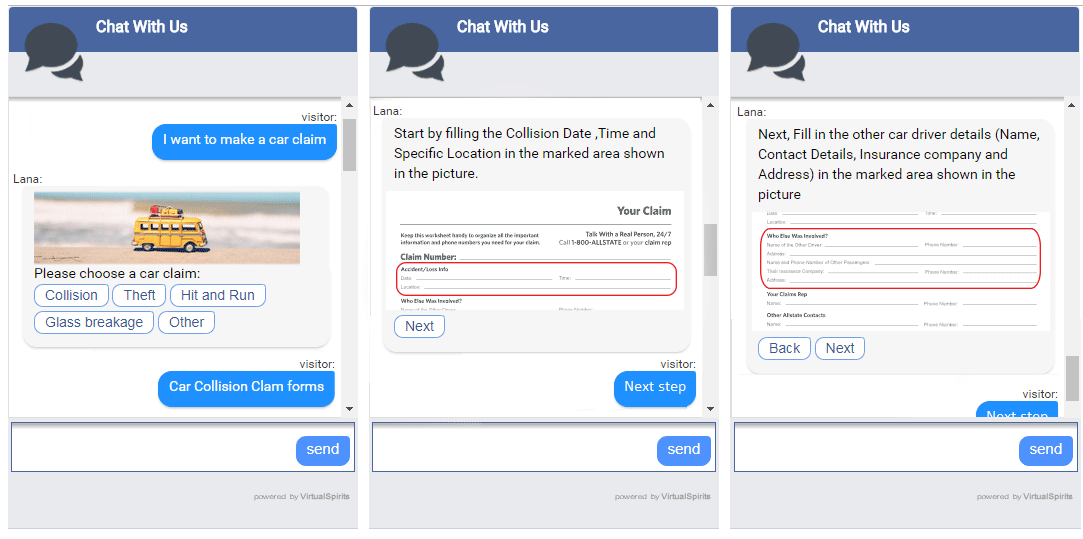

One of the biggest benefits of having a chatbot is that it improves the customer service to immense level. It can easily answer the customers’ questions in an understandable and simplest language possible. Moreover, chatbots are available 24/7 and can help with the questions that are mostly asked by the customers online.

ConclusionGiven that, cutting-edge technologies including Artificial Intelligence (AI) are bringing in big opportunity for insurance companies, they can increase their market share and have an edge over the competitors. Chatbots are one such example that not only can expand the customer database of insurance companies, but can also bring down their overall expenditures. And insurance companies that are reluctant to take advantage of this technology might miss out on a large number of customers who are keen to get insured and bring in more business for the companies.